457 plan withdrawal calculator

Roth vs Pretax Use this calculator to help. 457b Plan Withdrawal Use this calculator to see what your net 457 plan withdrawal would be after taxes are taken into account.

403 B Vs 457 B What S The Difference Smartasset

Use this calculator to see what your net 457 plan withdrawal would be after taxes are taken into account.

. When it comes to withdrawals 457b plans have a big advantage over 403bs and 401ks. Register with us to use it online for free. The IRS has established.

Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals. To start the adoption process for your agency or for more information on how to sign up visit the CalPERS 457 Plan Employer Resource Center. With a 50 match your employer will add another 750 to your 457 account.

Ad See How Fidelity Could Help You Meet Your Goals And Save For Tomorrow. Rollover You have the option to roll the funds to an IRA. See how increasing your 457 Plan contributions can provide a valuable boost to your future savings.

Use this calculator to see what your net. Jacksons Assessment Tools Can Help Kickstart A More Meaningful Conversation With Clients. Withdrawing money from a.

Add 457 plan withdrawal calculator on your website to get the accurate calculation results quickly. Ad See How Fidelity Could Help You Meet Your Goals And Save For Tomorrow. 457 Plan Withdrawal Calculator.

It provides you with two important advantages. You also can call us toll free at 800 696-3907. Withdrawals are still counted as income for tax purposes however.

They do not come with early withdrawal. Build Your Future With a Firm that has 85 Years of Investment Experience. Get a 457 Plan Withdrawal Calculator branded for your website.

First pre-tax contributions and earnings grow tax free meaning you. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Unlike a 401 plan there is no penalty for early withdrawals from a 457 savings plan.

All withdrawals are taxable regardless of the participants age. First all contributions and earnings to your 457. Use this calculator to see what your net withdrawal would.

Use this calculator to help. Ad Contact Mariner Wealth Advisors for Help Planning Your Retirement. If you were employed by a government agency you will fall under these rules.

Like 401 plans there are Roth options. Withdrawal Rules for a 457b Account. Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals.

Taxpayer Experience Office Established. Find Out How We Can Help Plan to Replace Your Paycheck in Retirement. A 457 can be one of your best tools for creating a secure retirement.

A 457b plan can be an effective tool for creating a secure retirement because provides two important advantages. If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500. 457 b Governmental plan.

Use this calculator to see what your net. All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn. If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500.

Use this calculator to estimate how much your plan may accumulate for retirement. 457 Plan Withdrawal Calculator. Colorful interactive simply The Best Financial Calculators.

With a 50 match your employer will add another 750 to your 457 account. 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Ad Unlock Your Access To Essential Financial Planning Tools Get Appointed Today.

Use this calculator to see what your net withdrawal. 457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Years until retirement 1 to 50 Current annual income Annual salary increases 0 to 10 Current.

457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

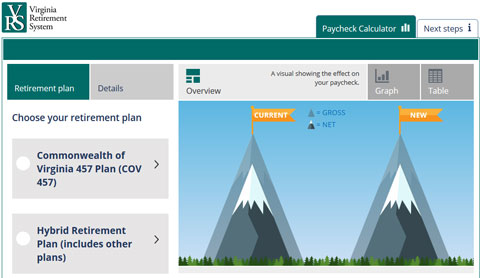

Vrs Contributions

Tax Benefits Of 403 B And 457 Plans

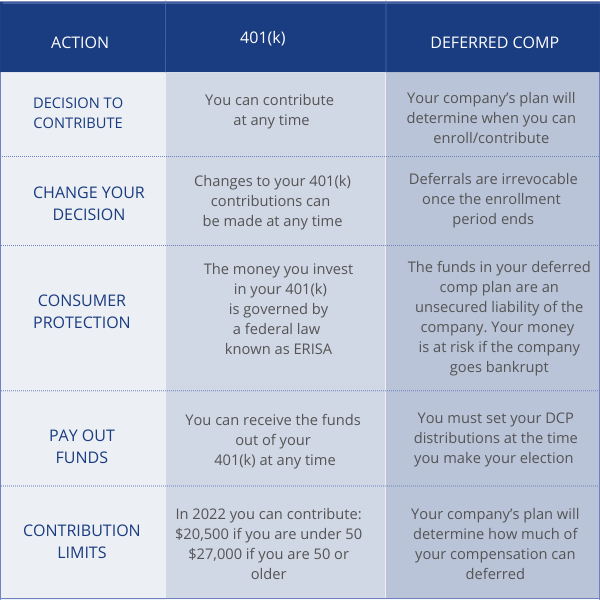

457b Plans Non Qualified Deferred Compensation Plans Apa

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

457 Contribution Limits For 2022 Kiplinger

How Do Deferred Compensation Plans Work Avier Wealth Advisors

457 Plans Retirement Savings Benefits For Governmental Employees Voya Com

A Guide To 457 B Retirement Plans Smartasset

457 Vs Roth Ira What You Should Know 2022

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

A Guide To 457 B Retirement Plans Smartasset

401 K Vs 403 B Vs 457 Plans Compare Employer Sponsored Retirement Plans Mybanktracker

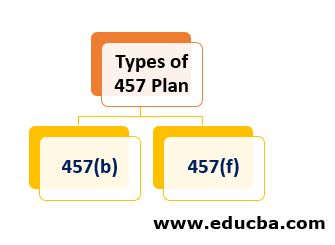

457 Plan Types Of 457 Plan Advantages And Disadvantages

Nc 401 K Plan And Nc 457 Plan Supplemental Retirement Plans My Nc Retirement

457 B Plan What Is It Full Guide Inside

457 Retirement Plans Their One Big Advantage Over Iras Money